tax fraud lawyer uk

HMRCs fraud investigations have led to more than 600 individuals being convicted for their part in tax crimes and commenced new criminal investigations into more than 610 individuals during the. This includes investigations regarding the alleged evasion of income tax corporation tax and VAT including missing tradercarousel frauds as well as investigations into tax.

Tax Avoidance Confessions Of An International Tax Lawyer 2018

Email us at helprichardnelsonllpcouk.

. Recognised as a national leader in the field of criminal fraud defence we are proud of our reputation and. Report Customs VAT or Excise fraud online. Phone us during office hours on 0333 888 4040.

Crown Court cases can be a. Because this is treated as tax fraud it could result in a tax evasion penalty of up to 70 per cent of the tax owed. Legal 500 UK 2020.

Tax fraud attorney Robert Barnes is thanked by Wesley Snipes following the not-guilty verdicts on all felony charges. Kopparberg argues that the UK applied excessive duties on imported alcoholic ciders by allowing domestic producers to dilute their products to avoid taxes. A QA guide to financial and business crime law in the UK England and Wales.

-- Indictment -- News Release. Discover which lawyers and law firms are ranked top for Tax. Prosecutions for tax fraud and other tax crimes HMRC has faced calls to do more to tackle tax fraud through criminal prosecution for some time.

Contact Robert Barnes directly at 213 330-3341 if youve been contacted by the IRS indicted arrested or convicted of tax fraud-related charges. HMRC-administered coronavirus relief schemes are the. Hylton-Potts - The London Based Law Firm helping people across the UK.

09-21-04 -- Cozzarelli Frank J. Cheating the public revenue Long before any of the statutory offences as detailed above were passed into law the tax authorities relied upon the common law offence of Cheating the Public Revenue. The maximum penalty for income tax evasion in the UK is seven years in prison or an unlimited fine.

Evasion of VAT in the magistrates court the maximum sentence is 6 months in jail or a fine of up to 20000. UK law enforcement has seized NFTs as part of an investigation into suspected tax fraud worth 19 million BBC reported Monday. Equality before the law.

12 Erroneous mistake or misunderstanding. HMRC reserve the right to launch a criminal. Swedish drinks maker Kopparberg has launched a High Court claim against the UK government accusing it of giving an unfair advantage to UK- based drinks producers through tax law loopholes.

Failing to prevent the facilitation of tax evasion is a serious offence in UK and persons accused of such crimes should seek immediate legal advice from our tax fraud lawyer. Chinnery Associates are specialist HMRC fraud lawyers and can advise you about any sentence which may be imposed arising out of tax evasion. Our team of expert tax lawyers has a proven track record of successfully defending both individuals and companies in civil and criminal HMRC investigations in the UK and overseas.

Request a free call back using the form on the right. We never allow our clients to be interviewed. Report tax fraud online.

If youve received a letter about an Interview Awkward Documents or Overpayments call or email us today. In fact Richard Hatch the first winner of the television show Survivor was recently jailed for not paying federal taxes on his 1 million winnings. Cozzarelli a Belleville lawyer has been indicted for tax evasion and filing false federal income tax returns for the years 1996 and 1997 the US.

Find out more in the Chambers and Partners UK guide. The support of our criminal defence lawyers in London starts with complete verification of the case which in most cases will involve the companys accountants. If you require more information about the services we provide or would like to discuss an issue with one of our expert fraud lawyers in strict confidence and without obligation then please contact us.

As UK tax law becomes increasingly complex businesses and individuals need specialist tax lawyers able to identify the risks and opportunities and to help them ensure compliance. 15 Destruction of documents and deliberate concealment. Punishment for not declaring income The most severe tax evasion UK penalties that can be charged are for deliberately misleading HMRC when completing a tax return and then taking steps to hide or attempt to hide the fraud.

HMRC the UKs tax authority said it was the first seizure of NFTs. 11 Financial penalties for tax evasion. Our tax lawyers have comprehensive knowledge of UK tax law and deep sector insight providing the highest level of legal advice to our clients.

Report HMRC-administered coronavirus COVID-19 relief scheme fraud. Hylton-Potts are experienced Benefit Fraud and Tax Credit Fraud Lawyers. An Overview Of HMRCs Approach To Tax Fraud.

Hamraj Kang the founding solicitor of the firm has won the Legal 500 award for Individual Criminal Fraud Solicitor of the Year as well. NEWARK - Frank J. In the most grievous cases of tax fraud and evasion penalties for UK tax fraud can go beyond punitive fines.

Belleville Attorney Charged with Tax Evasion Tax Fraud. The QA gives a high-level overview of matters relating to corporate fraud bribery and corruption insider dealing and market abuse money laundering and terrorist financing financial record keeping due diligence corporate liability immunity and leniency and. Both leading directories the Legal 500 and Chambers UK rank the firm in the highest categories for white collar fraud defence work.

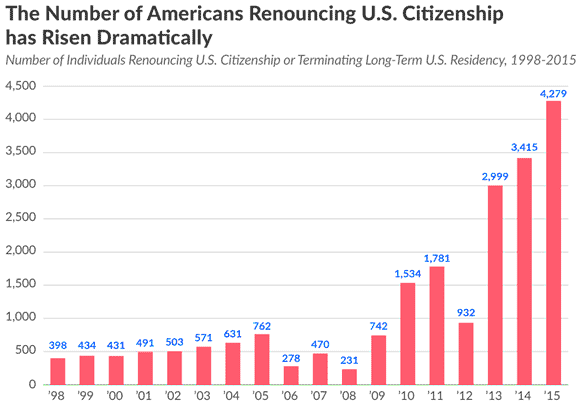

You may be fined or even jailed for tax fraud. A tax fraud attorney represents clients who the government claims have manipulated the system by paying too little tax or no tax at all. In 2015 Parliaments Public Accounts Committee described the number of prosecutions for offshore tax evasion as woefully inadequate1 In 2016 the Committee called on.

Harry Travers Greg Mailer and Umar Azmeh review HMRCs approach and argue that its failure to produce meaningful statistics should not mask the fact that it is criminally prosecuting low-hanging fruit. Income tax evasion penalties summary conviction is 6 months in jail or a fine up to 5000.

Attorney Involved In Biggest Tax Fraud Prosecution Ever Loses Appeal Of Conviction

Tax Evasion Latest News Breaking Stories And Comment The Independent

Tax Time 2015 Why Tax Cheats In Canada Are Rarely Jailed Cbc News

Richard Branson Tax Fraud How A Youthful Indiscretion Helped Create A Billionaire

Impact Of Tax Avoidance And Evasion Divorce Financial Proceedings

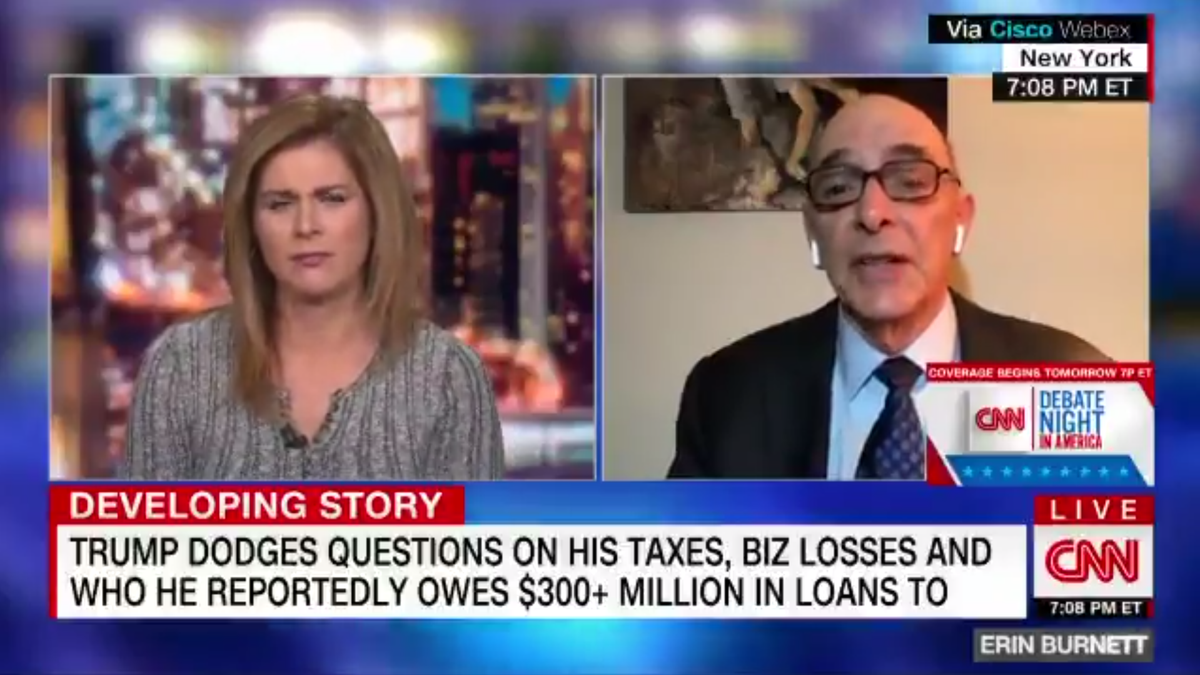

Trump Tax Returns No Question President And Daughter Ivanka Could Face Prison Says Watergate Prosecutor The Independent

Tax Avoidance Confessions Of An International Tax Lawyer 2018

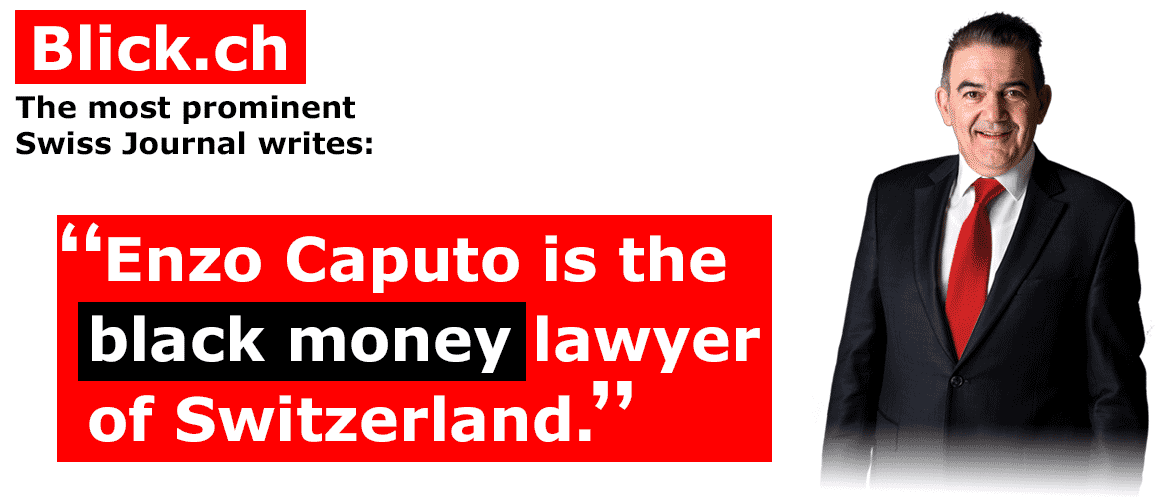

Tax Evasion Best Tips To Legalize Your Offshore Money Fast

My God This Is Some Street Level Mobster Stuff Lawyers On What We Know Now About The Trump Organization The Independent

Tax Avoidance Confessions Of An International Tax Lawyer 2018

Billionaire Brockman Innocent Of Tax Fraud U S Witness Says In Surprise Bloomberg

Tax Attorney Facing Prison For Allegedly Helping Billionaires Robert Smith And Bob Brockman Dodge The Irs

Tax Evasion By Jason Adam Katzenstein

What Is The Difference Between Tax Fraud And Tax Evasion

Tax Evasion What You Need To Know The Tax Lawyer

Two Manhattan Prosecutors Leading Criminal Tax Fraud Investigation Into Trump Resign Over Doubts Daily Mail Online